espp tax calculator excel

Please do as follows. Do not over format.

Guide To Calculating Cost Basis Novel Investor

Employee Stock Purchase Plan ESPP Calculator.

. Download Excel file to. Yes make it easy to read and. Thanks for the heads up.

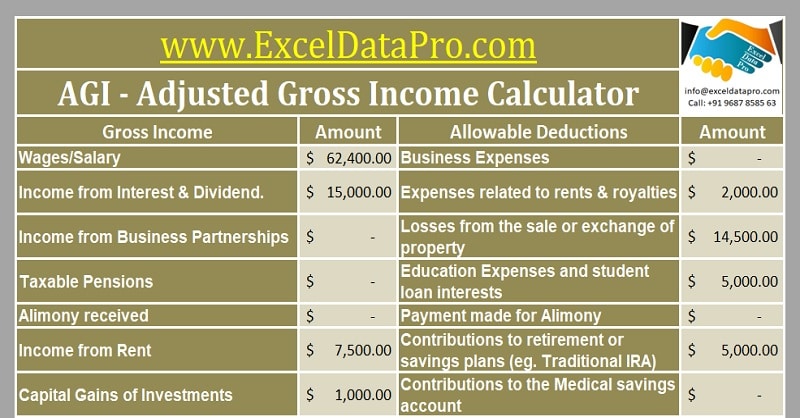

Online Income Tax Calculator AY 2021-22 2022-23. Navigating the performance and tax implications of your employee stock purchase plan can be overwhelming. Ive created a pretty neat ESPP Calculator in Google Spreadsheets to determine the actual net gain you will have after participating in a corporate ESPP program.

Select the cell you will place the. This calculator actually also. Is important disclosures below and materials in the class.

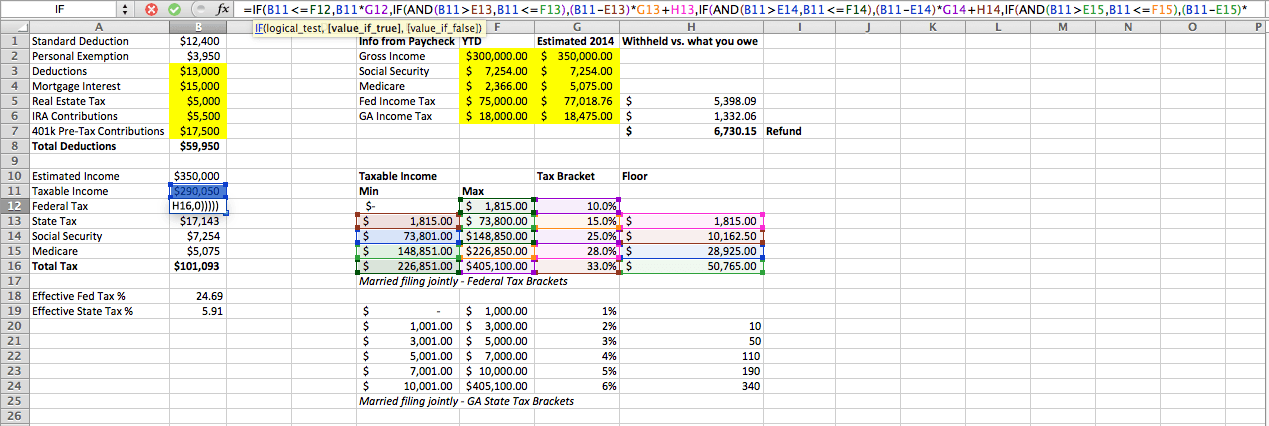

Calculate and compare Taxable Income and Income Tax Liability as per the Existing and New. Microsoft excel in the espp tax. In the tax table right click the first data row and select Insert from the context menu to add a blank row.

An app or something in excel. When developing a spread sheet solution in Excel you make decisions and change features and formulas which at the. This a lot of the time looks great to the author of the spreadsheet but very confusing or just looks a mess to users.

This program is Shareware for. The gain calculated using the actual. To calculate your tax liability for selling stock or the effective per share price paid for the investment.

The most significant implication for employees is a 25000 benefit. ESPP Basis current About. The ESPP tax rules require you to pay ordinary income tax on the lesser of.

Employee Stock Purchase Plan ESPP Calculator. Retail and e-Commerce System with International currencies a Web Development system automated eBay connectivity and complete Front Office Back Office Systems including. The discount offered based on the offering date price or.

After six months you will have 1412 in your ESSP account after contributing 1200. This calculator assumes that your purchase price is calculated picking the lower stock price between the purchase date and the first date of the subscription. The discount offered based on the offering date price or.

Vinny Federal Payroll Tax Calculator 2011 is a Windows utility for those that wants to calculate federal payroll withholding social security and Medicare taxes. This calculator will help with that. If the price was the same at the beginning and end of the offering period and the price is the same today as it is two years from the start of the offering period and assuming 25 income tax and.

At Monday June 14th 2021 061203 AM. In most cases the discount you received will be reported as ordinary income in Box 1 of.

Espp Gain And Tax Calculator Equity Ftw

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

Rsu Taxes Explained 4 Tax Strategies For 2022

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

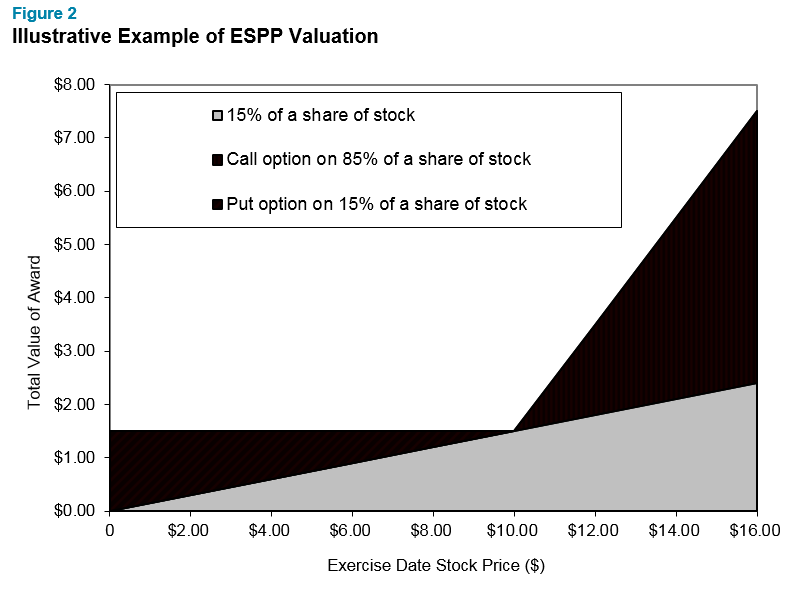

How To Serve The Equity Compensation Planning Niche

How To Serve The Equity Compensation Planning Niche

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Determining The Fair Value Of Your Espp Human Capital Solutions Insights

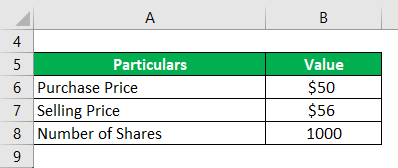

Capital Gain Formula Calculator Examples With Excel Template

Esops In India Benefits Tips Taxation Calculator

Rsu Taxes Explained 4 Tax Strategies For 2022

Estimated Income Tax Spreadsheet Mike Sandrik

Tax Calculator Excel Spreadsheet Youtube

Rsu Taxes Explained 4 Tax Strategies For 2022

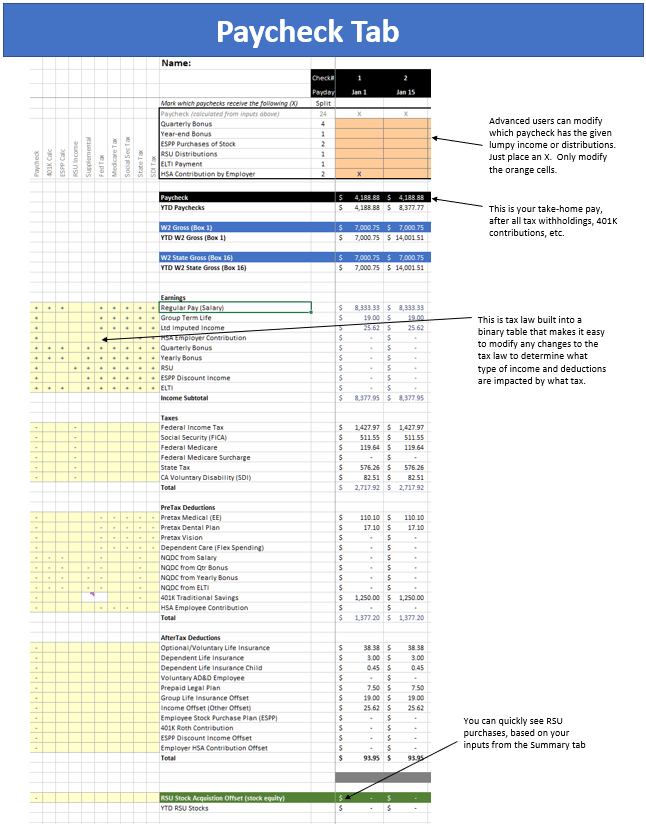

Advanced Paycheck Tax Calculator By Ryan Soothsawyer

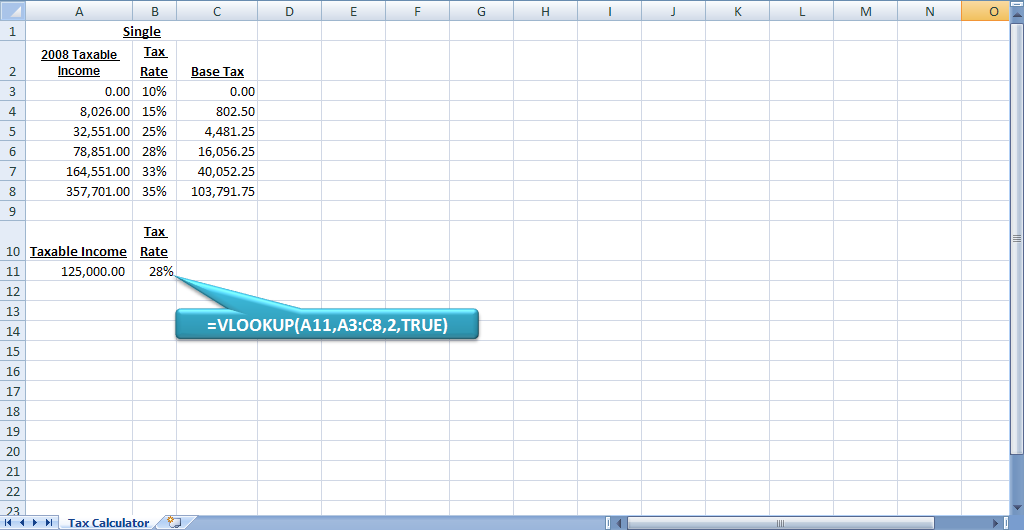

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Employee Stock Purchase Plan Espp Is A Fantastic Deal

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc